Track institutional Portfolios and Insider trading in real-time.

Track Insider Transactions

This section provides detailed information about the transactions of company insiders, such as executives, directors, and other key personnel. The data is collected from the insiders' Form 4 filings with the SEC, providing a reliable and up-to-date source of information. The insider screener and alerts can help you stay up-to-date and make more informed decisions about your investments.

Latest Insider Transactions

View all| Ticker | Insider | Transaction Type | Ownership Type | Shares Traded | Value / Price | Filing Date |

|---|---|---|---|---|---|---|

|

ZBIO

|

Leon O Moulder Jr

Chief Executive Officer |

BUY

Open market or private purchase

|

Direct | 20,000 Added 5.18% |

$331,000

$16.55 p/Share

|

Jan 09

2026 |

|

WRBY

|

David Abraham Gilboa

Co-Chief Executive Officer |

SELL

Open market or private sale

|

Direct | 19,906 Reduced 34.83% |

$579,065

$29.09 p/Share

|

Jan 09

2026 |

|

WRBY

|

David Abraham Gilboa

Co-Chief Executive Officer |

BUY

Conversion of derivative security

|

Direct | 19,906 Added 25.83% |

-

|

Jan 09

2026 |

|

WULF

|

William Joseph Tanimoto

Chief Accounting Officer |

BUY

Exercise of conversion of derivative security

|

Direct | 16,667 Added 27.39% |

-

|

Jan 09

2026 |

|

WULF

|

William Joseph Tanimoto

Chief Accounting Officer |

SELL

Sale (or disposition) back to the issuer

|

Direct | 5,296 Reduced 11.98% |

-

|

Jan 09

2026 |

|

RM

|

Forager Fund, L.P.

> 10% Shareholder |

SELL

Open market or private sale

|

Direct | 21,561 Reduced 2.07% |

$847,131

$39.29 p/Share

|

Jan 09

2026 |

|

WRB

|

Mitsui Sumitomo Insurance CO LTD |

BUY

Open market or private purchase

|

Direct | 275,000 Added 0.53% |

$19,082,250

$69.39 p/Share

|

Jan 09

2026 |

|

WYNN

|

Craig Scott Billings

CEO |

SELL

Payment of exercise price or tax liability

|

Direct | 5,081 Reduced 1.8% |

$598,694

$117.83 p/Share

|

Jan 09

2026 |

|

WYNN

|

Julie Cameron Doe

CFO |

SELL

Payment of exercise price or tax liability

|

Direct | 1,031 Reduced 2.25% |

$121,482

$117.83 p/Share

|

Jan 09

2026 |

|

WYNN

|

Jacqui Krum

EVP and General Counsel |

SELL

Payment of exercise price or tax liability

|

Direct | 270 Reduced 0.51% |

$31,814

$117.83 p/Share

|

Jan 09

2026 |

|

RDDT

|

Benjamin Seong Lee

Chief Legal Officer |

BUY

Exercise of conversion of derivative security

|

Direct | 3,320 Added 4.79% |

$26,294

$7.92 p/Share

|

Jan 09

2026 |

|

RDDT

|

Benjamin Seong Lee

Chief Legal Officer |

SELL

Open market or private sale

|

Direct | 3,320 Reduced 5.04% |

$863,930

$260.22 p/Share

|

Jan 09

2026 |

|

ARLO

|

Matthew Blake Mcrae

CEO |

SELL

Open market or private sale

|

Direct | 90,089 Reduced 8.13% |

$1,233,318

$13.69 p/Share

|

Jan 09

2026 |

|

ARLO

|

Kurtis Joseph Binder

CHIEF FINANCIAL OFFICER |

SELL

Open market or private sale

|

Direct | 55,043 Reduced 10.67% |

$753,538

$13.69 p/Share

|

Jan 09

2026 |

|

ARLO

|

Brian Busse

GENERAL COUNSEL |

SELL

Open market or private sale

|

Direct | 18,841 Reduced 3.31% |

$257,933

$13.69 p/Share

|

Jan 09

2026 |

|

RVLV

|

Michael Mente

CO-CHIEF EXECUTIVE OFFICER |

BUY

Conversion of derivative security

|

Indirect | 68,995 Added 0.0% |

-

|

Jan 09

2026 |

|

RVLV

|

Michael Mente

CO-CHIEF EXECUTIVE OFFICER |

SELL

Open market or private sale

|

Indirect | 68,995 Reduced 0.0% |

$2,129,185

$30.86 p/Share

|

Jan 09

2026 |

|

RVLV

|

Mmmk Development, Inc. |

SELL

Open market or private sale

|

Direct | 68,995 Reduced 100.0% |

$2,129,185

$30.86 p/Share

|

Jan 09

2026 |

|

RVLV

|

Mmmk Development, Inc. |

BUY

Conversion of derivative security

|

Direct | 68,995 Added 50.0% |

-

|

Jan 09

2026 |

|

RVLV

|

Michael Karanikolas

CO-CHIEF EXECUTIVE OFFICER |

SELL

Open market or private sale

|

Indirect | 68,995 Reduced 0.0% |

$2,129,185

$30.86 p/Share

|

Jan 09

2026 |

Insider Transactions Screener

Create custom screeners for insider transactions and receive instant notifications when new data is available in your screeners.

Explore the "Institutional Portfolios"

Gain a comprehensive understanding of the holdings of various institutions, including mutual funds, pension funds, and hedge funds. Find detailed information about the size and investment focus of each institution, as well as the latest updates on their portfolios. The data is collected from the institutions' 13F filings with the SEC, providing a reliable and up-to-date source of information.

Top Stocks Held by Institutions

Q4 2022 Institutional Trading Activity: Top Performing Stocks

Q3 2022 Institutional Trading Activity: Top Performing Stocks

Stay ahead of the game with timely notifications

Get a competitive edge with timely insights on the movements and trends of institutional investors and insiders.

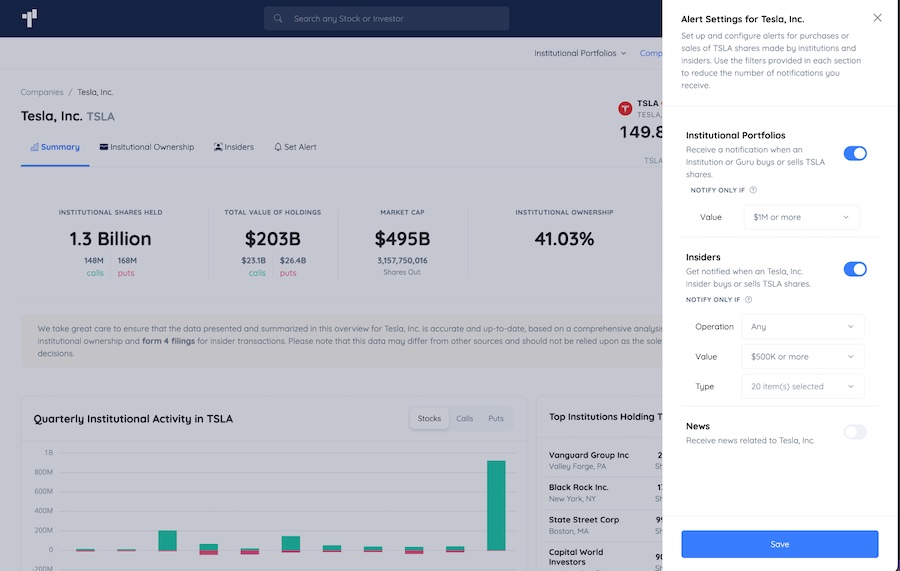

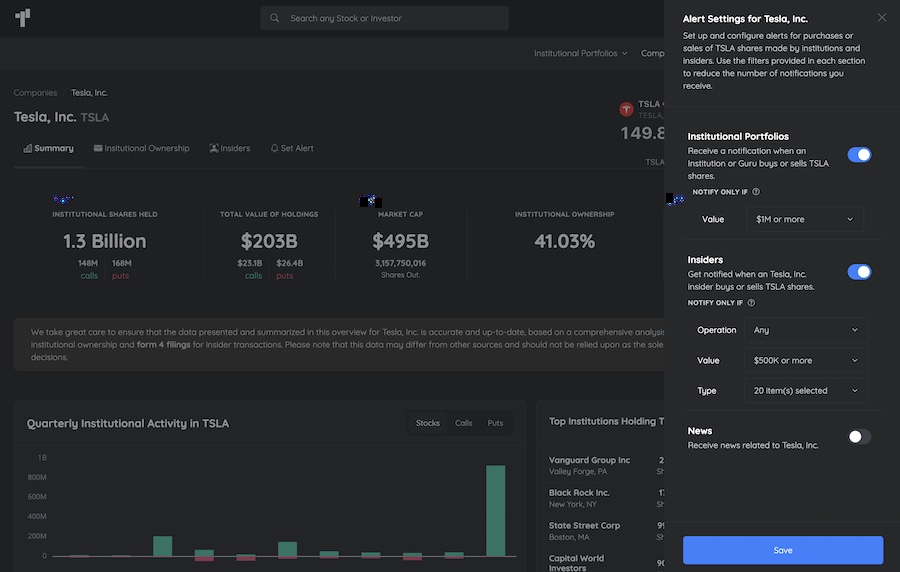

Create and Customize Alerts

Create personalized alerts for stocks or institutional investors, filter them to receive only relevant updates, and set up an insider screener to receive notifications when new data becomes available.

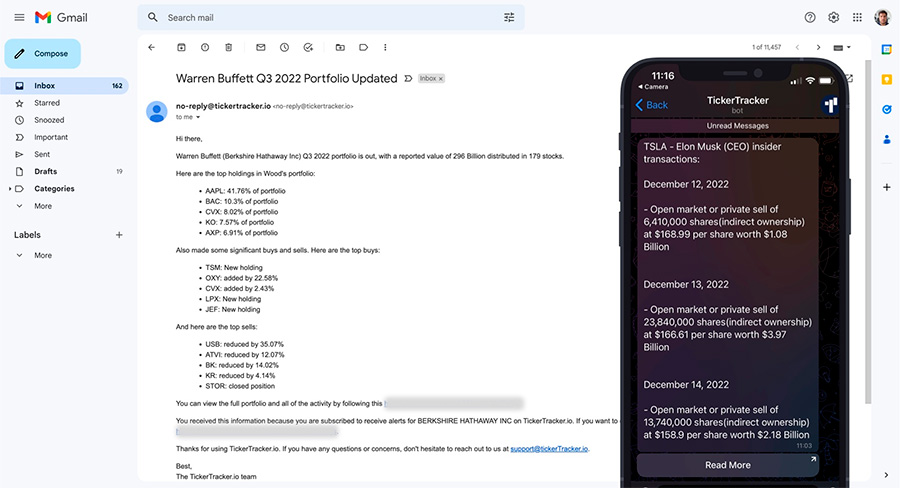

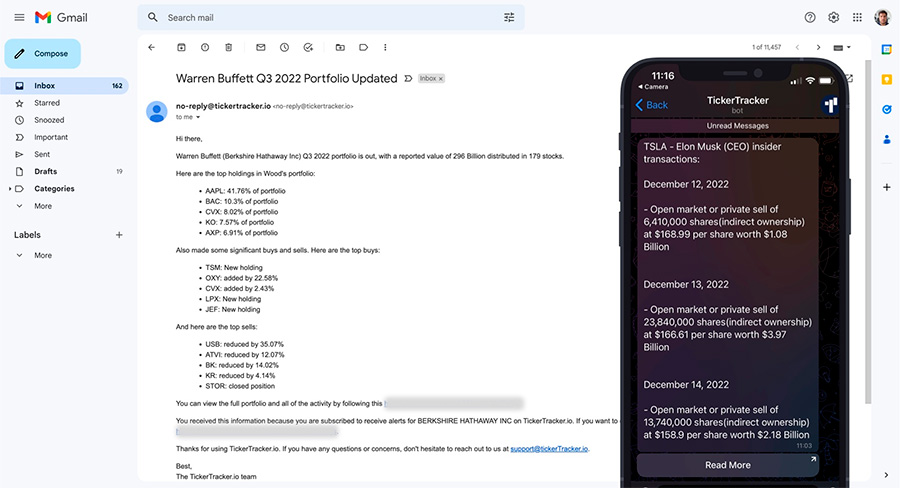

Real-Time Updates Keep You Informed

Receive real-time updates delivered directly to your Telegram or email. Choose your preferred delivery method and never miss a beat with timely notifications.

Latest Articles

CleanSpark vs. MicroStrategy: Evaluating Growth Potential in Bitcoin-Related Companies

Explore their fundamentals, growth prospects, and market challenges to make an informed investment decision.

Why Investing $1000 in BTC Today is the Best Decision for Your Children

Invest $1000 in Bitcoin today to secure wealth for your children's future.

Analyzing Robert Vinall Q4 2024 Portfolio

Discover the factors behind the $18.2 million decrease and gain insights into market volatility, strategic rebalancing, sectoral shifts.

Jamie Dimon's Vision: AI's Potential to Revolutionize Work and Health

Jamie Dimon, CEO of JPMorgan Chase, envisions a future where AI enhances both professional and personal lives.

Nat Simons' Meritage Group LP: A Deep Dive into the Q3 2024 Portfolio

Nat Simons' Meritage Group LP: A $3.77 billion diversified portfolio with strategic adjustments in Q3 2024. Top holdings include TransUnion, Aon plc, General Electric, Autodesk, and Workday. Insigh...

The Rise of ChatGPT and the Decline of Chegg: A Paradigm Shift in Online Education

Get expert assistance and answers to your questions with ChatGPT, the rising star in online education. Say goodbye to Chegg and embrace a new paradigm in learning.